This is an archived article that was published on sltrib.com in 2016, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

A group of Utah business leaders is turning to voters to raise funds for public schools.

The Our Schools Now initiative will begin collecting signatures next summer, organizers announced Tuesday, to place the question of an income tax increase on the 2018 ballot.

If successful, Utah's personal income tax rate would climb from 5 percent to 5.875 percent — a seven-eighths of 1 percent bump — netting roughly $750 million in new annual funding for the state's K-12 schools, colleges and universities and applied technology campuses.

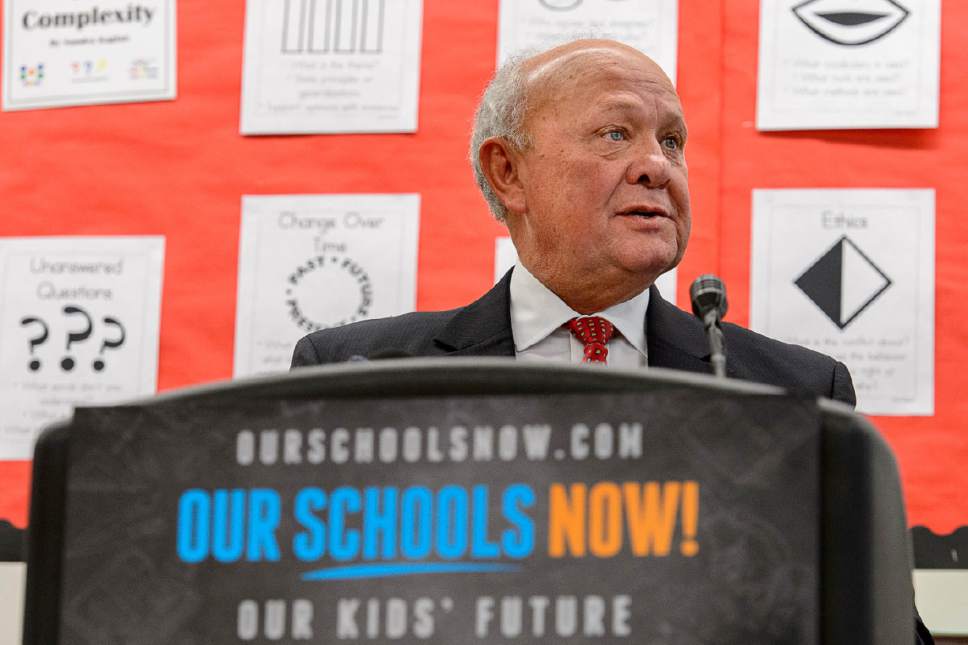

Nolan Karras, former Utah House Speaker, said Utah students deserve a first-class education and that current funding levels are insufficient.

"Constantly underfunding education has the potential to undermine the foundations of our economy and our society," he said.

Last year, Utah business-led advocacy groups Prosperity 2020 and Education First urged lawmakers to put a non-binding tax proposal before voters.

Lawmakers did not respond to the non-binding ballot option, which would have polled voters on their interest in a seven-eighths of 1 percent bump in income taxes.

Zions Bank president Scott Anderson said a ballot initiative provides "added emphasis" to the Legislature.

He was optimistic about securing signatures and the public's support, but added that lawmakers retain the ability to act during the upcoming legislative session.

"They may come up with a better idea that will not require the initiative," Anderson said.

If successful, the Our Schools Now initiative would distribute new funding to schools on a per-pupil basis and is estimated to generate $978 for each Utah student during its first year.

Funding would be given to all public education institutions, with school districts receiving roughly $629 million, colleges and universities receiving a combined $108 million and the Utah College of Applied Technology network receiving $6 million.

In addition to Education First, the Our Schools Now initiative is supported by the Utah Education Association, the Salt Lake Chamber and representatives from businesses and education groups throughout the state.

"Businesses endorse our schools now because they realize their success depends on a better-educated population," Anderson said.

A recent UtahPolicy.com poll found broad support — 67 percent — among voters for an income tax increase to fund schools. The poll, conducted by Dan Jones and Associates, included 812 Utahns and had a margin of error of 3.43 percent.

Additional results from that poll showed 30 percent of Utahns responding that they, personally, pay too little in income taxes.

Utah's income tax rate was lowered from 7 percent to 5 percent in 2007. That change, as well as other policy adjustments over the last 20 years, eliminated $1.2 billion in annual funding that would have otherwise gone to schools, according to a recent Utah Foundation report.

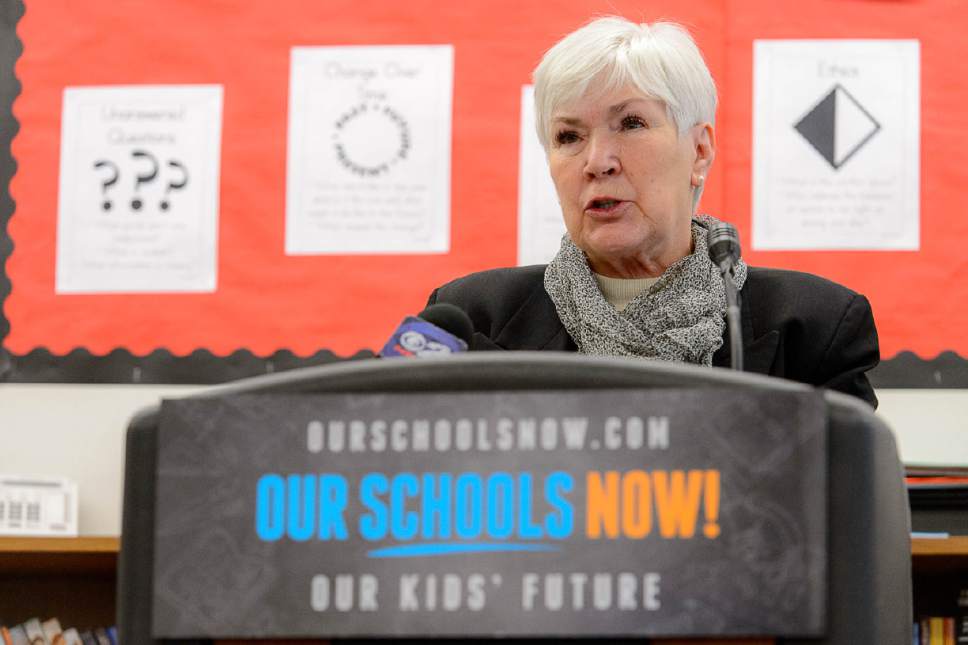

UEA President Heidi Matthews said she was encouraged by the support of the business community at a time when issues like school staff shortages and turnover have reached the public's attention.

"I feel like the time is right," she said. "Right now we simply do not have adequate funding."

But Christine Cooke, an education policy analyst for the Sutherland Institute, said education policy should be focused on students instead of dollars.

There's little correlation between increased funding and increased performance, she said, and Utah schools outperform the nation in metrics like graduation rates, science scores and Advanced Placement, despite being the lowest-funded in the nation on a per-pupil basis.

"Every state has room for improvement and Utah is no exception," she said. "But I think that we are sort of exaggerating the dire situation."

Utah law places several restrictions on ballot initiatives, including a requirement that signatures be gathered in 26 of the 29 Utah Senate districts.

The last major ballot initiative attempt, Count My Vote, was halted after lawmakers struck a compromise with organizers to create a dual-track system for political candidates to be listed on a primary ballot.

Medical marijuana advocates have also expressed interest in running a ballot initiative for legalization, with one attempt called off in April after organizers cited the high burden of gathering the required number of signatures.

In a prepared statement, Our Schools Now's co-chairman, Ron Jibson expressed confidence that the initiative would reach voters.

"We will get enough signatures of support in 2017 to get the initiative on the ballot in 2018," said Jibson, former chairman of Questar Corporation. "And, when communities see how much money they will receive, and how they can personally guide how that money will be spent, we believe they will vote in favor of Our Schools Now."

Twitter: @bjaminwood