This is an archived article that was published on sltrib.com in 2017, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

In April 2011, now-Utah House Speaker Greg Hughes and former House Majority Leader Kevin Garn formed a company seeking to construct an apartment building on land that Hughes owned in downtown Salt Lake City.

Five months later, the Utah Transit Authority selected a separate Garn company to be its partner in several transit-oriented developments (TODs). Hughes was UTA board chairman at the time, and he didn't disclose his business relationship with Garn.

He says such disclosure wasn't required because formation of the Brunswick Place LLC (limited liability company) was a preliminary step in a project that never got off the ground.

Besides, Hughes says, he didn't know that Garn was a partner in Thackeray Garn, which sought TOD contracts with UTA, even though the UTA board he led approves TOD contracts and receives updates on their progress.

If the Hughes-Garn company "had moved forward and was actually a business enterprise, I would disclose it," Hughes said in an interview this week. "That's why you didn't see that show up, because there wasn't a project that we actually did."

The Salt Lake Tribune is exploring Hughes' aborted business relationship with Garn (Brunswick Place LLC was dissolved in July 2013) because of an ongoing federal probe into current and former UTA officials, including scrutiny of TODs and real estate deals. UTA was given immunity last month in exchange for cooperation with federal prosecutors.

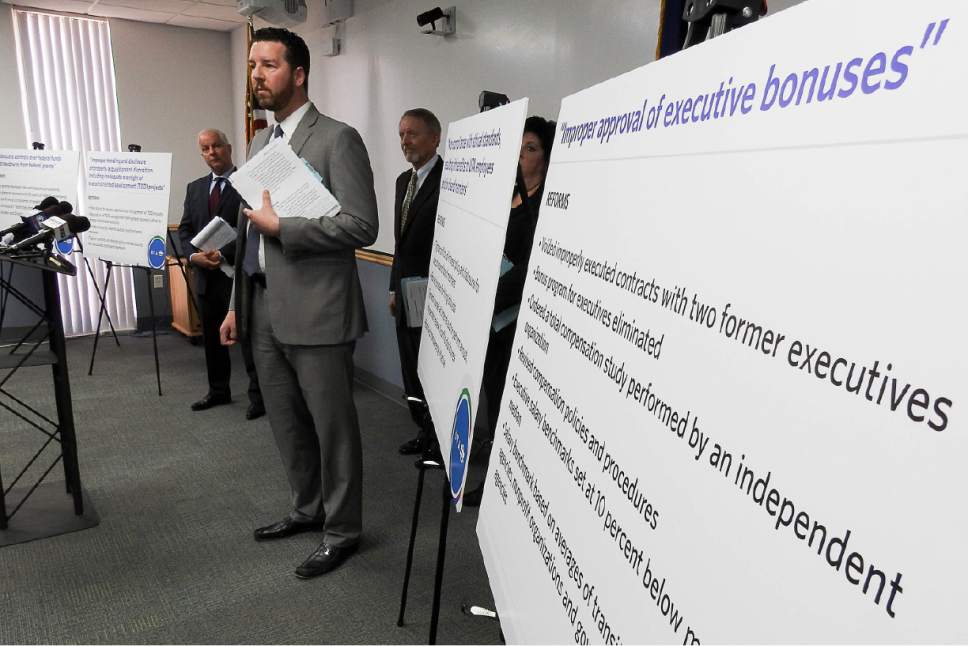

As part of its efforts to reform after a track record of sweetheart deals with developers, suspected insider dealing and high executive pay and bonuses, UTA has severed its ties with Thackeray Garn in six of seven TODs. (The remaining development was said to be too far advanced to withdraw.)

UTA said it was uncomfortable with Thackeray Garn's business involvement with former UTA board members, that at least one contract would have brought little money to the agency and that progress on developments was too slow.

Thackeray Garn disagrees with such characterizations, and partner Michael Christensen says the company agreed to drop out of most TODs because "they just didn't pencil out" and nothing improper occurred in its bidding or work. (He responded to Tribune questions because Garn was out of the country.)

UTA also recently gave Thackeray Garn land valued at $1.5 million for apartments at its Clearfield FrontRunner station in exchange for cutting all ties to a proposed TOD there, essentially paying the company to go away and avoid lawsuits.

When UTA was asked whether the Hughes-Garn business relationship created an advantage for Thackeray Garn in its bids, UTA General Counsel Jayme Blakesley said, "Due to the ongoing federal investigation, UTA cannot comment on this matter specifically."

—

Joint venture • Hughes and his usual business partner, Gary Nordhoff, joined with Garn on April 4, 2011, to form Brunswick Place LLC. Thackeray Garn partner Christensen said he was also involved with Brunswick Place as the project lead.

The company sought to build an apartment on a parking lot that Hughes and Nordhoff owned at 235 S. 200 East.

"It's a parcel I've owned since 1996 that I wanted to develop," Hughes said. "We needed a partner to do it, so we looked at potentially teaming up with Kevin."

The partners eventually decided the project wasn't feasible.

"There was some confusion with the city about whether we could build there," Hughes said. "We stared at it, and it didn't work."

Christensen added that forming a company "is not an uncommon practice" while still evaluating a deal.

"Before we start spending time and money, we want to make sure we have the framework of the business transaction," he said. "If it looks like we are going to go forward, we already have our deal structure worked out. If not, then it's disbanded."

He said the Brunswick Place project "just did not pencil. So I think in 2013 sometime is when it was a no-go decision."

Hughes said he eventually sold that land, and others now are developing the sort of project he had envisioned; he laments that he was unable to do so, figuring it would have been lucrative in today's tight rental market.

The fact that the apartment building never materialized, he said, is sort of proof that his dealings with Garn were not nefarious. If they had been, "I would have myself one heck of a building right now that I don't have."

—

Garn-UTA ties • In September 2011 — five months after Hughes and Garn created Brunswick Place LLC — UTA notified Thackeray Garn that it won the bid to be its partner to develop four TODs, at North Temple Station, Ballpark Station, Farmington Station and Murray Central Station, Blakesley said.

In 2012, UTA says it approved a deal by Thackeray Garn to obtain the ownership interest of another developer for a TOD at Clearfield Station.

And, in July 2013, Thackeray Garn was selected to develop two more TODs, at South Jordan Station and Meadowbrook Station.

So Thackeray Garn was selected to develop seven of the 12 total TODs for which UTA would eventually choose partners, all approved while Hughes served as board chairman.

However, Thackeray Garn would obtain operating agreements, or contracts, with approved site plans at two of those TODs — Clearfield and South Jordan.

While TOD contracts and plans are subject to UTA board approval and the board heard periodic updates on TOD progress, Hughes said he had no knowledge of Garn's role.

"I was unaware of any active involvement from Garn," Hughes said, adding he had no part in selecting Thackeray Garn.

"I don't know that I was aware of prospective TOD developers in certain stages of the game. The board works from a 30,000-foot level. I knew some of them," he said. "To the degree that Thackeray Garn was involved in other TODs, I was not aware."

Hughes says that, until informed by The Tribune, he also was unaware of the dates that show Thackeray Garn won bids a few months after he and Garn formed Brunswick Place LLC.

—

Nondisclosure • Blakesley said that under UTA rules in place at the time, "individual board members identified interests that they judged could present a conflict and disclosed them in an annual certification. Mr. Hughes did not disclose his role as manager of Brunswick Place LLC in any of his certifications to UTA."

Changes to UTA rules in 2015 — after Hughes departed — may have clearly required disclosure of relationships such as those that existed in the Hughes-Garn company, whether or not its project got off the ground.

"UTA requires all board members, executives and senior staff to disclose all financial holdings, outside positions, business relationships, agreements and gifts," Blakesley said. Then he and UTA's internal auditor "review the disclosures, identify potential conflicts and proactively work to resolve conflicts when and if they arise."

Blakesley added, "It would be inappropriate for a member to vote on a matter affecting his or her business partner."

Blakesley said he could not comment on Brunswick Place LLC specifically. "Due to the ongoing federal investigation, UTA cannot comment on the Hughes-Garn business relationship."

Abe Bakhsheshy, a business ethics professor at the David Eccles School of Business at the University of Utah — making clear that he would not talk specifically about Hughes' situation — said board trustees generally should disclose all potential conflicts of interest.

Board members have a responsibility "to make sure to reveal every single tie with that particular individual or group that he is going to do business with … even if there is a slight possibility of a conflict of interest."

The professor added, "It is better to disclose, even if you have the slightest doubt. ... If you think you might create some misperception among members of society, the due diligence is to reveal those types of conflict of interest."

Bakhsheshy added that board trustees generally have the responsibility to find out whether their business partners, or potential partners, may seek work with the groups they oversee.

"If there is a group of people who have invested trust and confidence in you, it brings a tremendous level of additional burden on your part to go out of your way and do the complete due diligence in order to prevent any possible misunderstanding or misperception on part of the public," he said.

—

Conflict and controversy • About eight weeks after Hughes formed the company with Garn that he chose not to disclose, he helped oust Terry Diehl, a developer and friend, from the UTA board amid disputes about whether Diehl properly disclosed potential conflicts of interest or tried to benefit from inside knowledge about where rail stations would be located.

As a sweetener for getting Diehl to resign, Hughes helped push through a waiver of UTA rules banning business dealings with former board members for one year after their departures.

Diehl was indicted last month on federal charges of making false statements in a bankruptcy and of concealing income, including allegations of not reporting more than $1 million received from a UTA land deal in Draper.

Documents in a civil lawsuit suggest that Hughes may have received hundreds of thousands of dollars from Diehl through the Draper project, though Diehl and Hughes have denied that assertion.

A statement provided to news organizations by Hughes' attorney Brett Parkinson at the time the UTA immunity deal was announced in early April said the House speaker had met with federal authorities, but he has been informed that he was not the target of an investigation.

"I have spoken with the U.S. attorney, who has confirmed to me that the speaker is not a target of this or any other investigation. Speaker Hughes has offered and continues to offer his assistance," Parkinson said. "In response to his offers of assistance, the speaker met with federal authorities [the last week of March]. Out of respect for their investigation, we cannot comment further."