This is an archived article that was published on sltrib.com in 2014, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

The Utah Transit Authority received two bits of good news Wednesday — the Comic Con's FanX convention last weekend helped it set a new three-day ridership record, and its somewhat worrisome credit rating has been upgraded.

"In three days — Thursday, Friday, Saturday — we had a quarter million trips on TRAX and FrontRunner. That's a record," UTA General Manager Michael Allegra told the UTA board.

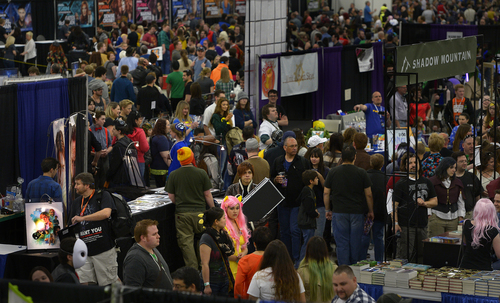

FanX operated those three days, which organizers said was attended by more than 100,000 people and set a record for a convention in the state. It allowed attendees to dress in science fiction and fantasy costumes, meet celebrities and roam a convention floor full of geek-centric shops and attractions.

Also boosting ridership, the Salt Lake Marathon and the University of Utah spring football game occurred Saturday, and the Mormon Tabernacle Choir offered sold-out Easter weekend concerts of Handel's "Messiah."

"Our operations people were working literally around the clock" to handle extra demand and expand schedules, Allegra said.

More good news came as Standard & Poor's — one of three major bond-rating companies — upgraded UTA's rating for its short-term bonds from a "A- Stable" to an "A Stable." That came as the UTA plans to refinance $142.4 million in short-term debt on Thursday.

UTA officials said the upgrade resulted from UTA revenue growth and because it is reducing its overall debt, which is expected to decrease by $610,000 on Thursday.

Bob Biles, UTA chief financial officer, said the new bonds will have a true interest cost to UTA of 1.27 percent. He said refinancing plus the better bond rating will save UTA about $3.8 million over the next three years.

Biles said 57 percent of UTA's current total bonds are long-term and rated AAA, and 43 percent are short-term bonds that are A rated.

UTA bond ratings had dropped in recent years, such as when Fitch Ratings downgraded them in 2011 from a AA- to an A+ (Fitch has reaffirmed that rating for the new bonds).

Fitch said then that UTA's "debt profile is somewhat weak" because of relatively heavy debt where "rising debt service has been shrinking revenues available for operations" and could hurt operations unless sales taxes picked up significantly. That came as UTA was finishing several new rail lines.