This is an archived article that was published on sltrib.com in 2013, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

Buying a new bottle of water every day versus refilling a container from the drinking fountain. Purchasing a new pair of jeans versus waiting until a current pair wears out.

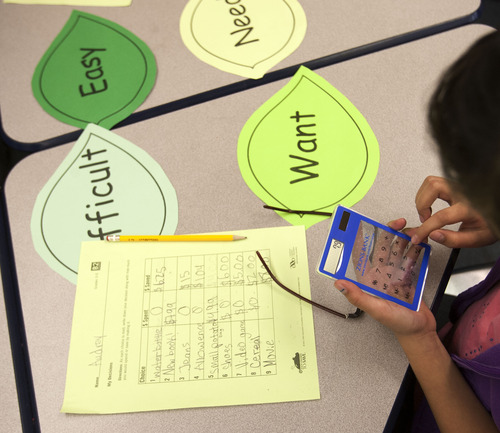

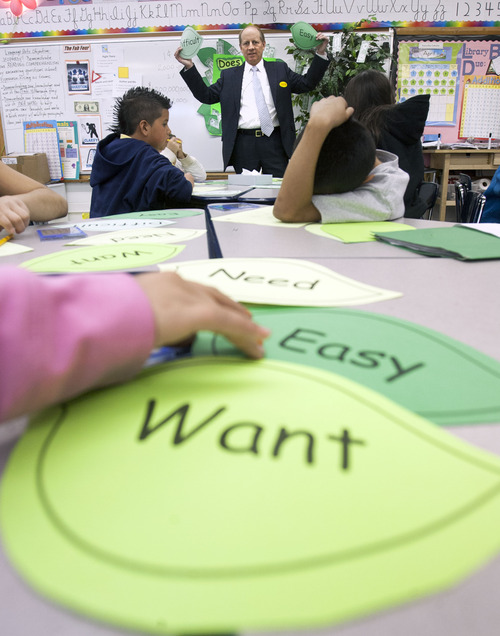

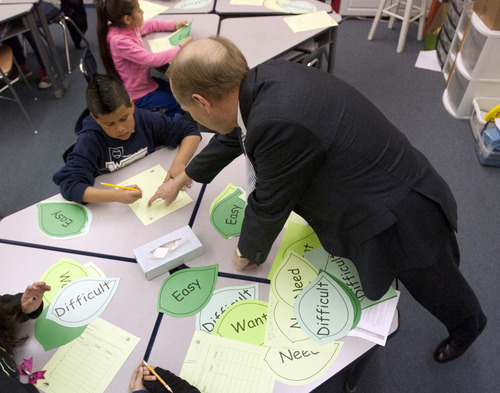

In each scenario that Zions Bancorporation President and CEO Harris Simmons threw out to fourth-graders at Salt Lake City's Guadalupe School, 10-year-old Audrey Palestino consistently chose the frugal option.

That is, until she had to decide between buying the next volume in the Lemony Snicket series or waiting until a library copy became available.

"That's a need," she said.

Distinguishing between needs and wants is a lesson Simmons and thousands of volunteers from various banks and credit unions have been teaching in classrooms and after-school programs across the state as part of Financial Literacy Month.

In a state known for high rates of foreclosures, bankruptcy filings and scams, Utah leaders have targeted financial literacy — helping students learn how to save, budget and prevent debt — as a public policy goal. In 2008, the Utah State Office of Education developed an online curriculum to help teachers teach about money management and lawmakers made passing a half-semester financial literacy course a requirement for high school graduation. This year, legislators passed Senate Bill 43, which creates a task force to study how to improve that high school class.

It's all a good start, but it's not enough, says Brian Nelson Ford, a personal finance consultant and author of The 8 Pillars of Financial Greatness.

"I think we're trending in the right direction, but we're not where we need to be," Ford said.

Ford said many children form their spending habits and patterns well before high school. And while teachers may be well-meaning, they often don't know enough about money management themselves.

"We need teachers who are a little more passionate and better trained in personal finance," he said. "We need to move away from 'textbook' personal finance and toward 'real world' personal finance."

State Sen. Pat Jones, D-Cottonwood Heights, agrees. This is why she sponsored SB 43 to assess what's working and what's not.

"A lot of people are going online and giving us feedback like, 'it's a waste of time' and 'it's not meaningful'," she said. "It's too hit and miss right now."

But that kind of evaluation is purely anecdotal at this point. Julie Felshaw, financial education specialist at the Utah State Office of Education, says the first group of students required to take the financial literacy class has only been out in the world for five years and the Legislature didn't fund any kind of ongoing assessment.

"It's going to be 15 to 20 years before we learn the impact of financial literacy classes," she said.

As far as teacher training, Felshaw says the state office does offer resources to boost teacher proficiency in personal finance, including an online course to help educators talk about money to various age groups. It also offers summer workshops to review standards and objectives. She said these resources are available but optional, and attendance is in the 50 to 60 percent range.

"We encourage them to attend, but in fairness to teachers, they've got a pretty full plate and a lot are not just teaching [personal finance]," she said.

Zions Bank's Simmons added that while financial literacy in the classroom is very important, lessons about money should largely take place in homes.

"It's something that parents can do," Simmons said. "Too often we rely on schools to do all of this. This is something that all of us as parents need to be teaching our kids."

Twitter: @jnpearce —

Resources for teaching financial literacy

Finance in the classroom • Games, lessons and activities to teach financial literacy to youth grades K-12 provided by the Utah State Board of Education. http://financeintheclassroom.org

Jump$tart Clearinghouse • An online library of financial education resources. http://www.jumpstart.org/jump$tart-clearinghouse.html

Tomorrow's Money • Basic financial information, including building credit and saving provided by the Utah state treasurer. http://www.utah.tomorrowsmoney.org

Believe in Your Future • Information, tools and resources for getting out of debt, saving for retirement or buying a home provided by the Utah Council on Financial and Economic Education (UCFEE). http://www.believeinyourfuture.org

MyMoney.gov • Online courses, articles and curriculum from the Federal Deposit Insurance Corp. (FDIC), Department of the Treasury and other federal agencies. http://www.mymoney.gov/category/topic1/youth.html