This is an archived article that was published on sltrib.com in 2013, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

With roughly 2 million Utahns expected to file tax returns this year and less than two weeks until the Tax Day deadline, The Tribune is providing down-the-stretch tips and reminders over the next 10 days to help you complete the right forms, apply for all the deductions and credits you can, and get your tax filings in on time by April 15.

Countdown Tip No. 10: Find free tax help.

First stop, the IRS • The agency's website, IRS.gov, has answers for pretty much everything, from which forms to use to new deductions available through the American Taxpayer Relief Act of 2012 (remember the fiscal cliff?). If you're intimidated by the volume of information on the website or just can't find what you need, call 1-800-829-1040 for personal tax questions and 1-800-829-4933 for business questions. Or you can actually walk into an area Internal Revenue Service office without an appointment, but be sure to check the schedule (see accompanying graphic or go to the website) to see if they offer the service you need.

Know the score • To see if you qualify for the Earned Income Tax Credit, check out the Earn It. Keep It. Save It. Coalition's website at http://www.utahtaxhelp.org. Free tax help also might be available to those whose annual household income is $51,000 or less through Volunteer Tax Assistance, or VITA. Call 2-1-1, a comprehensive, one-stop tax information source that also can help you find a location near you or make an appointment.

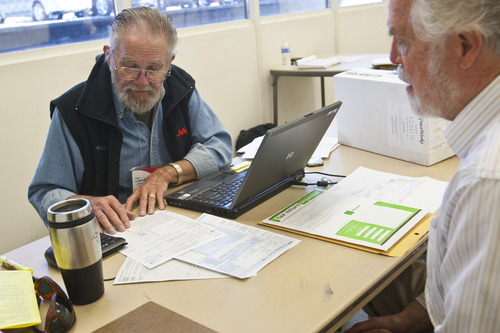

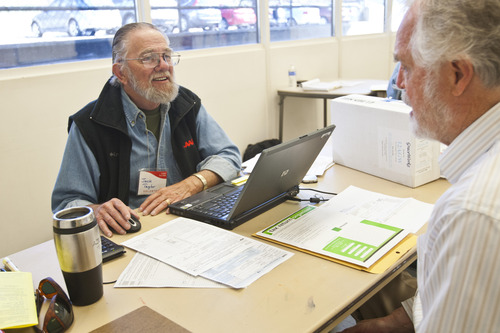

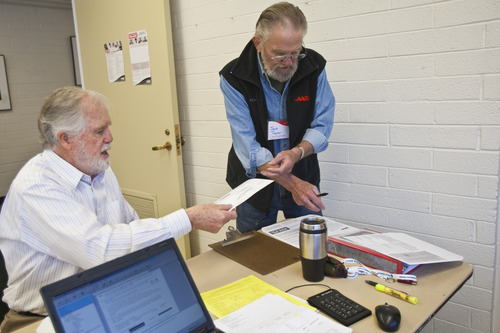

AARP assistance • Another program for low- to moderate-income taxpayers over age 60 is the AARP Foundation's Tax-Aide Program. The website http://www.aarp.org/money/taxes/aarp_taxaide/ has lots of helpful tips, or you can visit one of many AARP locations throughout Utah.

Coming tomorrow: How to avoid tax scams.

Twitter: @jnpearce —

Countdown to April 15, last-minute tips

Haven't filed your taxes yet? Beginning today, check out The Tribune's Countdown to Tax Day series with information that can help as the deadline approaches:

Today • Where to get free help (see chart, C6)

Friday • How to avoid tax scams

Saturday • The joys of filing electronically

Sunday • What's the Earned Income Tax Credit?

April 9 • Don't miss out on the Child and Dependent Care Credit

April 10 • Understand your taxes if you're self-employed

April 11 • Watch out for fees when paying taxes by credit card

April 12 • Reduce your taxes by saving for retirement

April 13 • Use the Taxpayer Advocate when tackling the IRS

April 14 • Don't ignore your taxes; file an extension to get more time