This is an archived article that was published on sltrib.com in 2012, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

Micron Technology Inc. is buying Intel Corp.'s stake in two factories for about $600 million, but the deal does not include the jointly owned IM Flash Technologies plant that makes flash memory chips in Lehi.

The Utah plant that employs about 1,600 people will continue to operate "with minimal changes to its existing operations," the companies said in a statement.

Micron will pay $300 million in cash for Intel's share of the other two facilities — one in Singapore and the other in Manassas, Va. Intel will deposit $300 million with Micron to help pay for so-called NAND flash chips supplied by its partner.

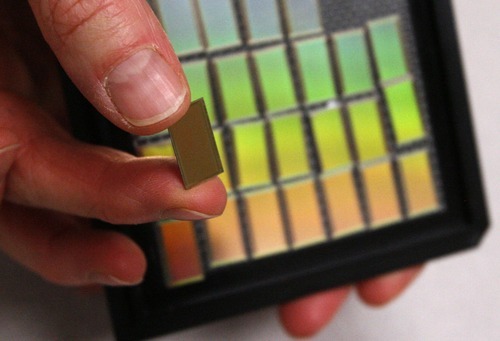

Those chips are used to store media and other files in devices such as Apple Inc.'s iPhone and iPad and are increasingly being used in computer storage to replace hard disk drives.

Micron owns 51 percent of the IM Flash plant in Lehi and Intel the rest in a joint venture that began in 2005.

Micron spokesman Dan Francisco said Wednesday no changes had taken place in that relationship.

The agreement on the other two plants is aimed at "improving the efficiency and flexibility" of the wider joint venture between the two companies, he said.

The deal also extends the two chipmakers NAND flash development program to include new technologies.

"We've extended and expanded the joint development program for both NAND and as well as what we're calling emerging memory technologies, and we're not being more specific there," Francisco said.

The shares of Micron, the largest U.S. maker of computer-memory chips, rose the most in two months Tuesday after Japanese rival Elpida Memory Inc. filed for bankruptcy. Analysts, including Kevin Cassidy at Stifel Nicolaus & Co., have said Micron may acquire some of Elpida's facilities and convert them to produce NAND flash chips.

"This is $300 million in cash coming out of Micron, so it's $300 million they won't use for something else," Cassidy said. The conversion of Elpida's facilities to produce NAND flash memory "could cost several hundred million dollars and take a year," the Washington-based analyst said.

On Wednesday, Micron shares declined 3.72 percent, or 33 cents, to finish the day at $8.55 on the Nasdaq.

The transaction is scheduled to close in the first half. Micron said in December it had $1.9 billion in cash at the end of the most recent quarter.