This is an archived article that was published on sltrib.com in 2010, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

Sun-kissed St. George is Utah's epicenter of the Great Recession and its repressed recovery.

It wasn't long ago the city was flying high. With its population up more than 50 percent, the place once dubbed a boomtown by Inc. magazine was one of the fastest-growing metros for most of the decade. Jobs followed. In the three years before the recession's onset, employment rose 25 percent.

All that has changed. Today, despite an outward show of prosperity, the city and surrounding Washington County are mired in a downturn deeper than other areas of the state, says Mark Knold, chief economist at the Utah Department of Workforce Services.

What has come to pass in St. George over the past three years is in many ways emblematic of the hardships faced by adjacent counties that lean on it for sustenance — Beaver, Garfield, Iron and Kane.

And although all of southwest Utah has struggled, Washington County's travails have been the most dramatic.

"It was the top area that got pounded, based on employment losses," said Knold, who estimates Washington County lost nearly 15 percent of its jobs from early 2008 to the start of this year. The state as a whole, by comparison, was off 7 percent.

Dragged low by a ruinous implosion of home building and property values, local employers are still shedding jobs, mostly in construction trades and businesses that feed off real estate. St. George is beset by unemployment above 10 percent more than a year after the recession officially ended. And the rate is still rising.

"Initially, I felt pretty confident I could find another job because I was always able to. But the jobs weren't there," said Cherie Johnson, a divorced mother of four who lost her hotel clerking job 11 months ago when room rentals dwindled.

Housing hit hard • Foreclosures are seemingly unending. Two St. George banks are weighed down by worrisome levels of past-due real estate loans. Kaysville's Barnes Bank, which loaned heavily in Washington County, failed earlier this year. Federal regulators closed Southwest Federal Community Federal Credit Union in June. For the first time since 1964, more people moved out of Washington County last year than moved in.

"We lived and died by the real estate market," said Brian Chadaz, president of Heritage Bank in St. George. Unlike some of his rivals whose lending standards were more indulgent, Chadaz's bank wasn't as badly damaged when home prices collapsed. Prices for the most expensive houses have fallen as much as 50 percent; anything above $350,000 is down at least one-third. Even modest homes lost 20-25 percent of their value, he said.

"Washington County led the nation a few years ago, as far as property values increasing, which led to some speculation. So when the housing burst, we were ground zero," Chadaz said.

To one degree or another, the story across the mesas, mountains and canyons of southwest Utah is much the same. Construction has dried up seemingly everywhere.

"Our market was a lot of Vegas people," said Kevin Frandsen, whose K&D Forest Products company in Panguitch manufactures high-end log houses.

"Their homes were appreciating so fast that a lot of them were able to buy second homes [with cash]. That's all changed," said Frandsen, who has furloughed 16 of his 24 employees.

Son Nick said K&D sold 30 homes in 2007. The number dropped by half in 2008, and by half again last year. The company has sold four homes in 2010, hardly a surprise, given that unemployment in Las Vegas is above 14 percent.

"It's even harder this year than it was last year," Nick Frandsen said.

Unemployment high • Collectively and separately, the five counties are enduring some of the highest unemployment rates in the state, ranging in October from a low of 8.6 percent in Kane to a high of 11.3 percent in rural, tourism-dependent Garfield. Joblessness across the region is closer to the U.S. average than it is to Utah's rate. Although Workforce Services economist Knold sees signs of a statewide recovery taking hold, the sense at street level in the five-county region that the worst has passed is guarded at best.

"To say it's bottomed out, I don't know. I wish I had a crystal ball," said Marc Wittwer, chief operating officer of Boulevard Home Furnishings, a 100,000-square-foot megastore that draws customers to St. George from as far north as Millard County and from Page, Ariz., to the southeast.

Teresa Banks, who manages Workforce Services offices in the five counties, can't say for sure, either. "The economic recovery that is happening in other parts of the state seems to be lagging here."

Banks said the people her job counselors see span the economic spectrum, unlike in better times. Last week, 1,052 people who registered at the St. George office actively looking for work had bachelor's degrees. Of that number, 217 have master's or doctorates.

High unemployment is affecting spending. Wittwer has adjusted his furniture inventory to appeal to more modest tastes. Instead of bank funds, Boulevard Furniture uses its own money to finance no-interest loans. And the company has not replaced employees who have quit.

In Beaver County, Mike Rosenlof, who owns Mike's Foodtown on Beaver's Main Street, says some customers are dipping into their food stockpiles in order to feed their families. Others are buying staples such as tuna and soups in bulk to stretch their dollars. The store redeems more food stamps than ever before.

"People just buy the necessities on food now, versus the fun stuff. They are back to the basics of eating and not really spending more than what they have to," Rosenlof said.

Folks flee, credit dries • In Iron County, which depends on manufacturing more than its neighbors, factory jobs dried up in 2006, a year ahead of the financial collapse on Wall Street. To conserve cash, manufacturers began to shed hundreds of workers. Since peaking in the fall of that year, almost 470 jobs have been eliminated. Manufacturing has slipped from 11 percent of the county's work force to about 9 percent.

The losses have hurt. Economic development director Brennan Wood said the elimination of one manufacturing job typically leads to the loss of 1½ jobs elsewhere.

Wood has seen a number of businesses close their doors. Estimates are difficult because there is no requirement to report when a business doesn't renew its operating license, so proof is mostly anecdotal.

Nevertheless, Wood said, "we've just seen a lot of turnover where typically we would not."

And like Washington County, net migration turned negative. Last year, 203 more people moved out of Iron County than moved in. It was the first loss since 1989, when another recession was brewing.

"I think this recession was the worst one," said Steve Jolley, who has owned Jolley's Ranch Wear on North Main Street in Cedar City for 19 years. "I have family members involved in several parts of the economy — medical, manufacturing, real estate, building. Everybody's felt it."

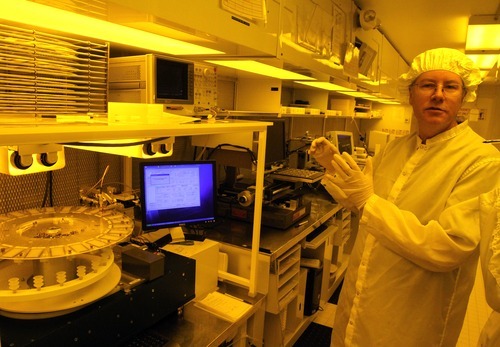

David Neumeier, president of Cedar City-based Xeco Inc., which makes quartz crystal blanks for use as timing devices inside telecommunications transceivers and satellites, saw orders plateau during the recession. Sales haven't picked up much because end users of his products aren't convinced the recovery is real. Orders that come in are spot purchases rather than buying for the long term, Neumeier said.

"It's like a really evil version of just-in-time [buying], which makes it very difficult to make any plan or projections of any kind," he said.

His biggest headache, though, has been with the banks he usually turns to for credit. Traditional financing has almost dried up, and Neumeier has been forced to turn to Xeco's owner, a U.S. company he said he's not permitted to identify.

"I've chosen to go down another road because the traditional credit line is not possible," Neumeier said.

Kanab makes do • The tourism-reliant city of Kanab watched its sales and resort tax revenues plunge as jobs in some sectors of Kane County's economy shriveled more than 50 percent from 2007 to 2009. Construction, which leans on the hustle and bustle of building in Washington County, was especially hard-hit. Employment plunged 54 percent in the period, and is off even more this year.

Between 2007 and this year, Kanab's revenue fell 40 percent when the bottom fell out of the housing market, property values dropped, jobs dried up and consumer spending slowed, according to city figures. The county's unemployment rate in September was the highest since 1996, and more than twice what it was when the recession began.

"We were just taken aback at the amount," said Ed Meyers, a city councilman. "We were to the point where if we hadn't taken some pretty sound management practices, we would have been in a world of hurt."

The city has plugged much of the shortfall by drawing on funds it banked from the sale of a golf course three years ago and Kanab's municipal power company in 2004. That pared the 2007-2010 budget deficit to 18 percent, but the city's cushion of rainy day cash is depleted. The sharp job losses that began early in 2008 and got steadily worse last year ended abruptly in January, said Kelly Stowell, executive director of the Center for Education, Business and the Arts, an economic development group.

"It's hard to point at one specific thing, but there is some improvement," Stowell said.

Kanab has avoided layoffs and deep service cuts, even though it axed 9 percent from department budgets. It recouped some revenue by imposing a new tax on propane and electricity, and from a local-option transient room tax. The city also froze hiring, made do with old police cruisers, and put off several capital improvement projects, manager Duane Huffman said.

St. George is key • The region's recovery hinges on St. George. Scott Hirschi, director of the Washington County Economic Development Council, said the recession has undermined the confidence of anyone connected to the real estate market. Construction traditionally accounts for 15 percent of county employment. But when other housing-dependent businesses are counted, real estate probably represents one-third of the local economy, Hirschi said.

Chadaz, the Heritage Bank president, said home prices have stabilized "a bit," especially at the lower end of the market, but he doesn't believe the market has reached bottom.

"There is still a lot of notice-of-defaults that are being filed, and that leads to further downward pressure on home values, which leads to lower prices. Until we start creating some jobs, and people come in and buy up the inventory, it stands to reason that prices aren't going to recover," Chadaz said.

Dan McArthur, St. George's mayor for 17 years and president of McArthur Welding, has watched the city's budget shrink and his company's orders shrivel over the past three years. City revenues are off 18 percent. His welding sales are down by a similar amount.

McArthur's optimism is unflagging, though. He thinks the recession has pushed families to be more prudent about their spending. Housing has become more affordable; most homes under $200,000 are gone. After falling by two-thirds from 2007 to 2009, building permits for single-family homes are up this year.

What excites McArthur most is the city's new municipal airport, which opens in January. The $160 million facility can handle aircraft as large as a Boeing 737. SkyWest Airlines, based in St. George, will replace turboprops with jet service to Salt Lake City. The airline is also considering flights to Los Angeles, the mayor said.

McArthur doubts St. George will ever see growth of the type it experienced before the downturn, which he says is probably a good thing as the city waits for better days ahead.

To get help

For job training and information, visit http://www.JobsUtah.gov.

The Five County Association of Governments (http://www.fcaog.state.ut.us) has information about human and economic development services.

For assistance, visit http://www.utahhelps.utah.gov —

To get help

For job training and information, visit http://www.JobsUtah.gov.

The Five County Association of Governments (http://www.fcaog.state.ut.us) has information about human and economic development services.

For assistance, visit http://www.utahhelps.utah.gov