This is an archived article that was published on sltrib.com in 2013, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

The Tribune is providing down-the-stretch tips and reminders to help you complete the right forms, apply for all the deductions and credits you can, and get your tax filings in on time by April 15.

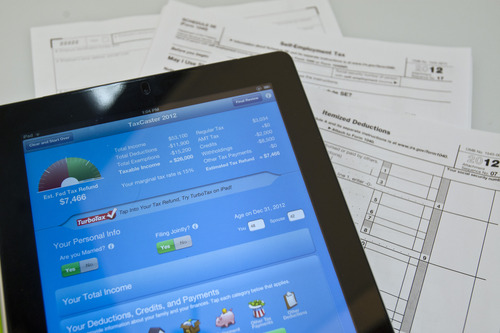

Countdown Tip No. 8: File electronically.

Forget about paper forms, calculators and stamps.

Filing your taxes electronically saves you from math errors, can get you a refund faster and you won't have to fight the lines to mail your return (sorry, U.S. Postal Service).

A few things to keep in mind if you're one of the nearly 100 million taxpayers filing online:

Find the tax software that's right for you. You've got many options, but the big names include TurboTax, H&R Block and TaxAct. There also are fillable forms through the IRS website, but these are best for people who are comfortable preparing their own returns. If your adjusted gross income is less than $57,000, you can use Free File, the full IRS online software package. But remember that the Free File service doesn't include state tax forms.

Use a secure wireless connection. You don't want to take a chance sharing your Social Security Number and all of your personal financial information over an open, public WiFi service. Make sure you're on a password-protected connection and that you use a strong password when you e-file.

Sign your return. You'll need to do this by requesting an Electronic Filing PIN — that's your electronic signature.

Wipe the slate clean. Once you've filed your taxes, make sure all of your confidential information is off your computer. Save everything onto a flash drive or CD, then permanently erase.

Coming up tomorrow: What's the Earned Income Tax Credit?

Twitter: @jnpearce —

Countdown to April 15, last-minute tips

Haven't filed your taxes yet? Check out The Tribune's Countdown to Tax Day series with information that can help as the deadline approaches:

April 4 • Where to get free help

April 5 • How to avoid tax scams

Today • The joys of filing electronically

Sunday • What's the Earned Income Tax Credit?

Tuesday • Don't miss out on the Child and Dependent Care Credit

Wednesday • Understand your taxes if you're self-employed

Thursday • Watch out for fees when paying taxes by credit card

Friday • Reduce your taxes by saving for retirement

April 13 • Use the Taxpayer Advocate when tackling the IRS

April 14 • Don't ignore your taxes; file an extension to get more time