This is an archived article that was published on sltrib.com in 2017, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

The Utah Transit Authority warns that it cannot afford all the TRAX extensions, new bus rapid transit routes and additional streetcar systems now in long-term regional transportation plans — unless residents approve a big tax hike.

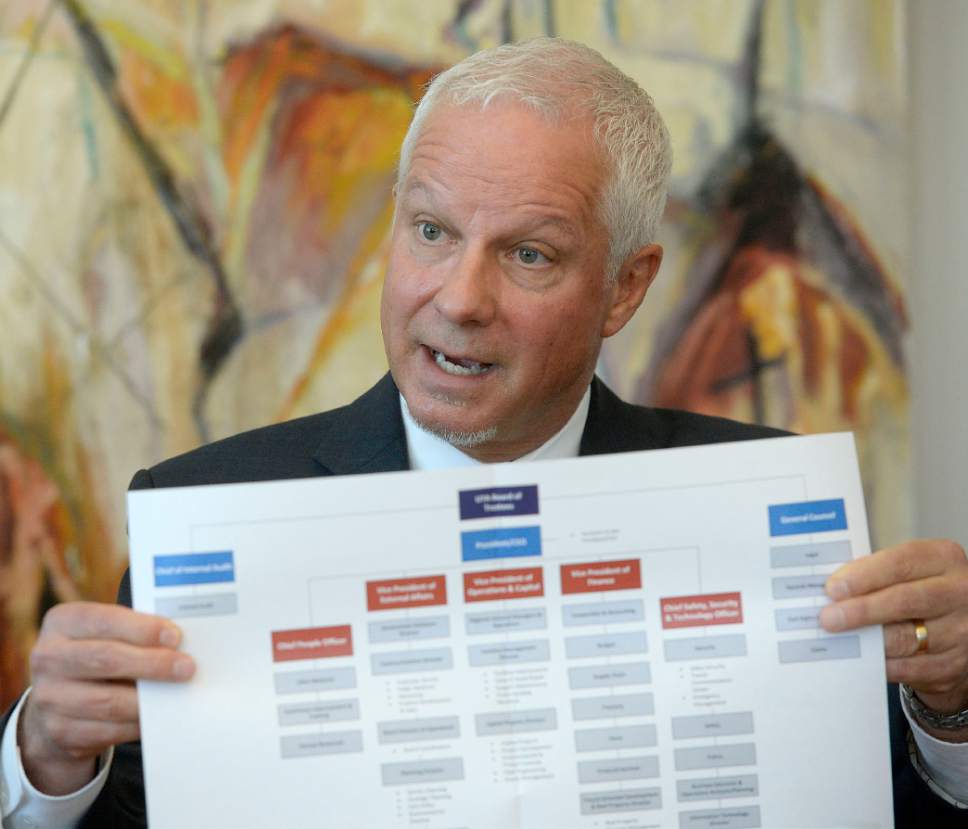

"They really can't be accommodated in our current level of funding," says UTA President and CEO Jerry Benson.

He adds that when counties and cities developed regional plans through 2040, they generally assumed the sales tax for transit would be a penny per dollar by now. It is far below that.

It is .69 of a cent per dollar in Salt Lake County. Raising it to a full penny per dollar would require a 45 percent sales tax boost.

Other counties served by UTA tax less for transit, so they would need bigger increases to reach a penny per dollar. The rates now charged are.65 of a cent per dollar in Davis and Weber counties; .55 of a cent in Utah and Box Elder counties; and.40 of a cent in Tooele County.

After recent scandals at UTA and a new immunity deal during an ongoing federal probe into agency dealings with current and former officials and contractors, Benson acknowledges that UTA has work to do to build public trust before it may win support for tax hikes. But he says the agency is working on that with reforms, and that includes greater transparency about funding challenges.

The funding gap is discussed in written talking points that UTA has given its board members to bring to the attention of the cities, counties and other elected officials who appoint them.

"As a state, we are falling behind in transit. The capacity doesn't currently exist to meet the growing demands of the state," the talking points say — adding that a transit sales tax rate of at least a penny per dollar is needed.

"We need to be honest about what we have and what we do with what we have," Benson said in an interview. "That's what this message is trying to convey."

—

Big plans • The Wasatch Front Regional Council's transportation plan through 2040 envisions many expensive transit projects in coming decades — which UTA now says are unaffordable.

They include:

• New Salt Lake City streetcar lines on 200 South and in the Granary District, and extending and improving the existing Sugar House line.

• Stretching TRAX southward into Utah County, and westward from Salt Lake City International Airport to the International Center and perhaps beyond.

• Many new "bus rapid transit" (BRT) lines, sort of TRAX on rubber wheels in which long buses often have their own traffic lanes and tickets are sold by machines before boarding.

BRT routes planned in Salt Lake County include: Foothill/Wasatch drives, 700 East, 1300 East, State Street, Redwood Road, Bangerter Highway, 5600 West, Taylorsville-Murray-Holladay, 5400 South, Fort Union Boulevard, 9000 South and 12300/12600 South.

• New BRT lines that would run through Davis County to Salt Lake City and Ogden.

• A new downtown streetcar in Ogden, and a streetcar or BRT between downtown Ogden and Weber State University.

UTA is building a new BRT line in Provo and Ogden. But Benson says "the next BRT lines that are on the docket will need to have capital and operating funds identified before we can move forward."

Without a full penny per dollar sales tax for transportation or significant other sources such as federal grants, "we need to scale back our expectations," he says.

Benson adds that a 1 percent tax "would put us on par with other cities that maybe we would consider peers, like Denver, Houston, Dallas and Portland. Other communities have gone beyond that. If you go to Los Angeles right now, they are at 2 cents and a quarter, or something like that."

—

Assumption • Wasatch Front Regional Council plans to prioritize projects based on resources that are reasonably expected, says Andrew Gruber, executive director. Projections of a penny per dollar in transit sales tax by now were made as early as 2000.

His staff is updating revenue projections now for the next regional plan update, due in 2019.

Gruber says projects in current plans are not a comprehensive list of everything officials want, but a pragmatic prioritization of the most-needed projects that may be covered by projected funding.

"All of the investments that are in the unified transportation plan are crucial to helping Utah respond to its rapid population growth. We are the fastest-growing state in the nation," Gruber says. "We have to make investments in our roadway, transit and active transportation [biking, walking] systems in order to make sure we have good mobility, good air quality and a strong economy going forward."

—

Shortfalls and debt • Lower-than-projected sales tax is not the only issue complicating expansion of UTA services. The challenges are compounded by lingering effects of the recession and heavy debt incurred to expand rail systems in recent years, Benson says.

Voters in 2006 approved higher taxes to expand TRAX and FrontRunner systems — and, by 2013, the agency completed projects that had been planned through 2030.

"We have about $2 billion in debt now" because of borrowing to speed up those rail projects with bonds guaranteed by future sales tax revenue, Benson says.

"We spend more on debt service than we do on bus service," about $114 million a year, he notes. "Our current debt load is about a third of all our total operating budget" — so the agency does not want to incur additional debt for more projects that it then might not be able to afford to operate.

"We just don't want to go further," Benson says. "And if we don't have the operating budget to operate the services once we build something, then what's the point?"

Because of the recession and residents spending less, sales tax for transit did not generate the amount of revenue that UTA had projected when it decided to accelerate its rail projects. So the agency has not been able to afford other pieces of the service expansion that it had envisioned.

Residents "want more and better service. If not for the recession that would have been the case. We would have had $80 million more in service," Benson says, including $40 million a year more in bus service, $30 million in TRAX operations and the rest in commuter rail.

—

Challenges • "It's really not our job to advocate or campaign [for a tax hike]," Benson says. "It's our job to inform policymakers and the public so they can make good decisions."

Still, he acknowledges that many obstacles exist for passage of a tax increase — including public mistrust from past controversies, and convincing voters that new projects and expanded service are needed.

The agency has made numerous reforms in recent years seeking to improve trust, after state audits blasted it for sweetheart deals with developers, high executive pay and bonuses and extensive international travel. Federal prosecutors last month announced the immunity deal that includes hiring an independent monitor.

"It's important that we have credibility and trust," Benson says.

Many mayors and legislators say a lack of public trust in the agency led to the 2015 defeat of Proposition 1 to raise transportation taxes in Salt Lake, Utah and Box Elder counties (although it passed in Davis, Weber and Tooele counties).

Evelyn Everton, state director of Americans for Prosperity, a conservative group that opposed Prop 1, vows to fight any new tax hike.

"It has only been a year and a half since voters in the two most populated counties rejected Prop 1, which would have given UTA more tax dollars. Since that time, UTA has done very little to gain public trust," she says.

"From closing public meetings to internal squabbling amongst board members to being monitored by federal prosecutors for the next three years, UTA continues to prove itself bad stewards of our tax dollars," Everton adds. "Americans for Prosperity and our activists across the state will continue to oppose any tax increases that give UTA more tax dollars."

Benson acknowledges the agency must show the public the value of expanded transit service and projects.

"People have a high opinion of the service that UTA delivers," Benson says, "and they want more of it."

He adds, "Whether they use it or not, they need to feel like an investment in public transit is going to make this community a better place for everyone. And they have to have confidence that their money is going to be used well. Public trust for any tax-supported agency is critical."