This is an archived article that was published on sltrib.com in 2017, and information in the article may be outdated. It is provided only for personal research purposes and may not be reprinted.

A group of roughly 30 Utahns stood on the snowy steps of Utah's State Capitol Thursday, urging lawmakers to abandon plans to increase the state's sales tax on food.

The proposal, pushed by Senate Republicans, is intended to stabilize sales tax revenue by combining a hike in grocery taxes with an overall decrease in Utah's sales tax rate.

But to Art Sutherland, an advocate with the Coalition of Religious Communities, the Senate's plan is less an example of the oft-repeated mantra to "broaden the base and decrease the rate" and more akin to a 21st century version of "Let them eat cake."

"It's not broadening the base," Sutherland said. "It's punishing the base."

Opponents criticized the food tax as a regressive tax that would disproportionately affect Utah's low- and middle-income residents, who spend a larger share of the dollars on essentials like food.

"It's a weird, unfair way to generate revenue for the state," said Bill Tibbitts of the Crossroads Urban Center.

Tibbitts was similarly skeptical of the corresponding plan to lower Utah's sales tax rate. The two adjustments might be revenue-neutral for state coffers, he said, but not for working families.

"If you buy a Ferrari, then you come out ahead," he said. "You have to spend an awful lot of money on non-food items, money that these families don't have, to come out ahead."

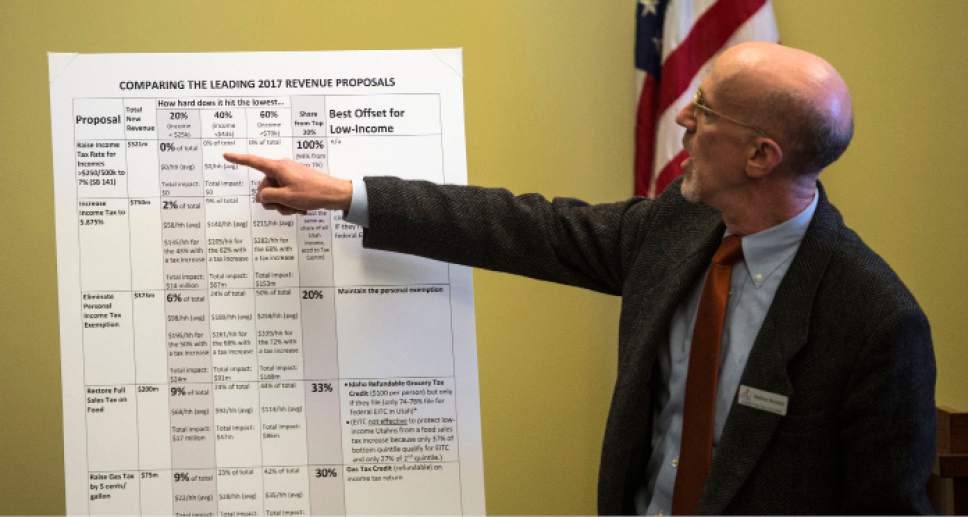

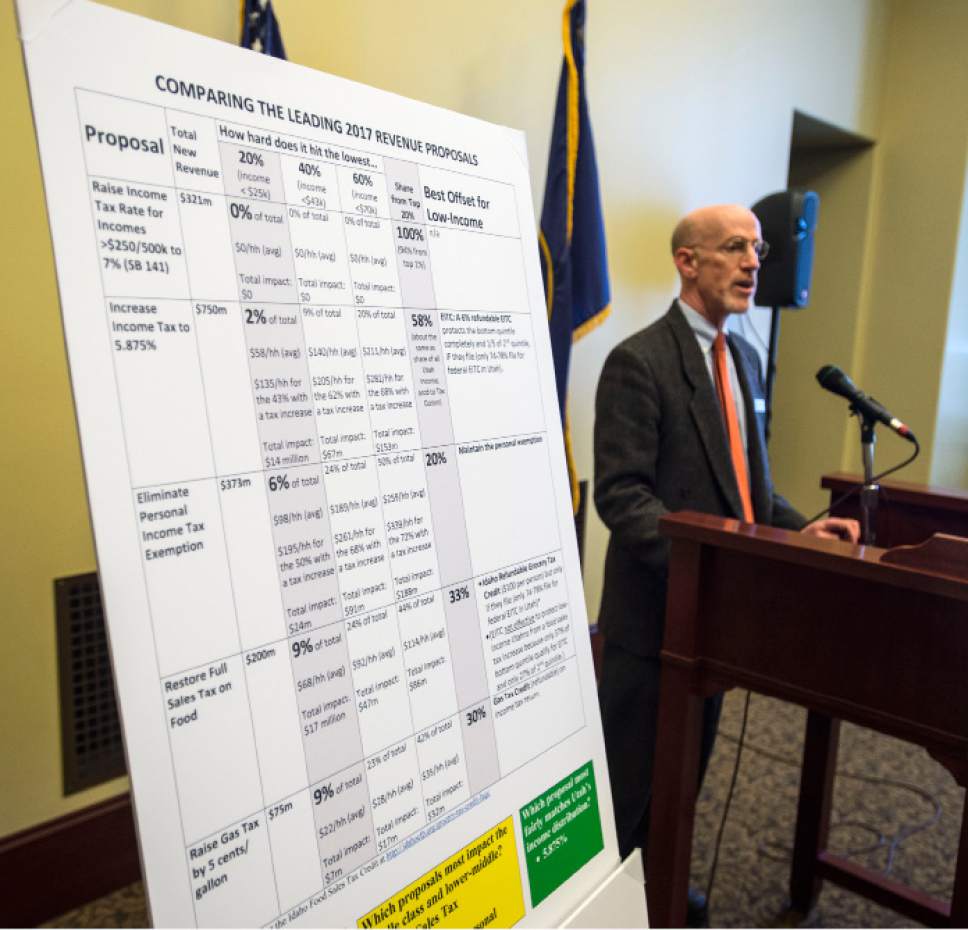

The demonstration on the Capitol steps came shortly after Voices for Utah Children released an analysis of various tax proposals under discussion at the state Legislature.

Matthew Weinstein, the organization's state priorities partnership director, said that increases in food and gas taxes have the largest impact on Utah's poor, while a proposed ballot initiative to increase the income tax from 5 percent to 5.875 percent more closely follows the distribution of income throughout the state.

Increasing the income tax rate to 5.875 percent would cost between $350 and $400 each year for a median income-earner, according to Voices for Utah Children.

That ballot initiative, sponsored by the group Our Schools Now, would raise $750 million for the state's Education Fund, with 2 percent of that total borne by the lowest 20 percent of Utah income earners, according to Voices for Utah Children.

But the lowest-earning 20 percent of Utahns would carry 9 percent of the cost of restoring the full sales tax on food, the report states.

Weinstein also said that while the cost of grocery taxes would impact all Utahns, the benefit of a decreased sales tax rate would be shared with customers from outside the state.

"It carries out a tax shift from in-state to out-of-state residents," Weinstein said. "Tourists don't buy a lot of groceries when they're here."

Voices for Utah Children, along with several community advocacy groups released a letter to lawmakers on Thursday. It states that new revenues are needed for state programs, but poor Utahns should be held harmless by tax reform.

"No one should be taxed into or deeper into poverty," the letter states.

Senate President Wayne Niederhauser said lawmakers are considering several different taxing options, including proposals that would lessen the impact on low-income Utahns. That said, he said that everyone in the state should expect to have some "skin in the game" when it comes to funding state services.

The state's share of social and support service programs are financed by sales tax revenue, he said, and a predictable, consistent revenue stream is needed to maintain those efforts.

"Everybody should be paying a little bit into the system," Niederhauser said, "no matter what your income or what your situation is."

Weinstein said his group was not taking positions of support or opposition on individual proposals, including the Our Schools Now initiative.

"We are simply laying out the numbers and encouraging legislators to consider the impact on lower-income populations," he said.

But others were more than willing to state their opposition to a grocery tax hike.

Gina Cornia, executive director of Utahns Against Hunger, said a higher tax on food carries a significant impact for families who are trying to stretch out a gallon of milk or a loaf of bread for a few extra days.

"It could mean the difference between making it until pay day and having to go to an emergency food pantry," she said.

Rev. Kim James of Ogden's First United Methodist Church said low-income Utahns are already struggling. She suggested there is a moral responsibility for the state to take care and support families in poverty.

"Jesus cares about the hungry," she said. "He fed the thousands, we should do the same."

Twitter: @bjaminwood